Medi Weight Loss typically does not accept insurance. Coverage varies, so check with your provider.

Medi Weight Loss offers a clinically proven approach to weight management, combining medical oversight, personalized plans, and one-on-one counseling. This comprehensive program focuses on integrating sustainable lifestyle changes that foster long-term weight loss and improved overall health. Designed to deliver results through a tailored plan, it targets the unique metabolic needs of each patient.

Support from medical professionals and nutritionists bolsters the journey to a healthier self. Understanding insurance coverage is crucial, as patients often bear the cost, but investment in health yields valuable returns.

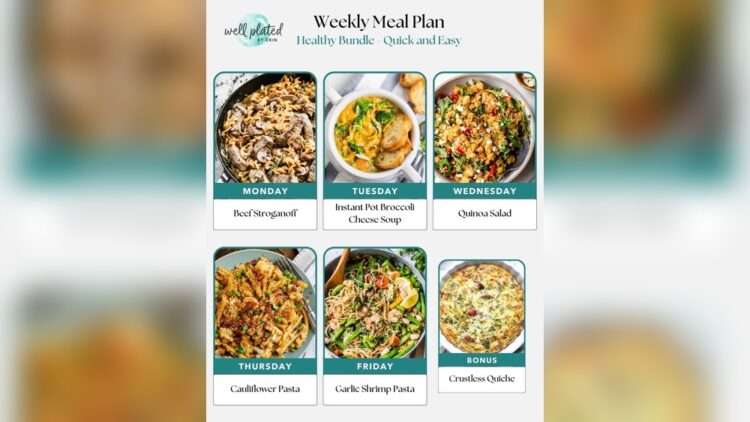

Credit: www.facebook.com

Introduction To Medi Weight Loss

Medi Weight Loss clinics have become increasingly popular for those seeking weight loss solutions. A key focus is on customized plans that cater to individual needs. This approach combines clinical support, nutritional education, and wellness strategies. People often explore if their health insurance covers these personalized programs.

The growth of Medi Weight Loss clinics highlights the success of their personalized care model. With a team of experts, each patient gets a tailored weight loss journey. Success stories fuel the expansion of these clinics. Patients value the structured plans that aim not just for weight loss, but also for a healthy lifestyle shift.

Insurance And Weight Loss Programs

Understanding insurance coverage for weight loss is crucial for many individuals. Often, insurance policies include specific terms regarding obesity treatment and related programs. It’s important to know that coverage varies widely among insurers. Some insurance plans may cover doctor visits, dietary counseling, and weight loss surgeries. Others might only provide partial coverage or even none to some procedures. Reading your policy thoroughly or contacting your insurance provider is the best step to confirm your coverage details.

Medi Weight Loss And Insurance Facts

Medi Weight Loss may accept insurance coverage, depending on various factors. Each patient’s insurance plan can differ significantly. Patients need to verify coverage directly with their provider. The type of insurance you have is a key factor. Specific plans may include weight loss treatments as benefits. Employer arrangements might also influence coverage.

Patient eligibility could affect insurance use. Documentation of weight loss necessity may be essential. Speak with your insurance company to understand your policy. Not all services at Medi Weight Loss might be covered. Always check for exclusions or limitations.

| Factor | Influence on Insurance Acceptance |

|---|---|

| Type of Insurance | Plans differ, affecting coverage. |

| Policy Specifics | Inclusions for weight loss matter. |

| Employer’s Health Plan | May offer additional benefits. |

| Patient Eligibility | Must meet insurer’s conditions. |

| Policy Reviews | Direct clarification with insurer is crucial. |

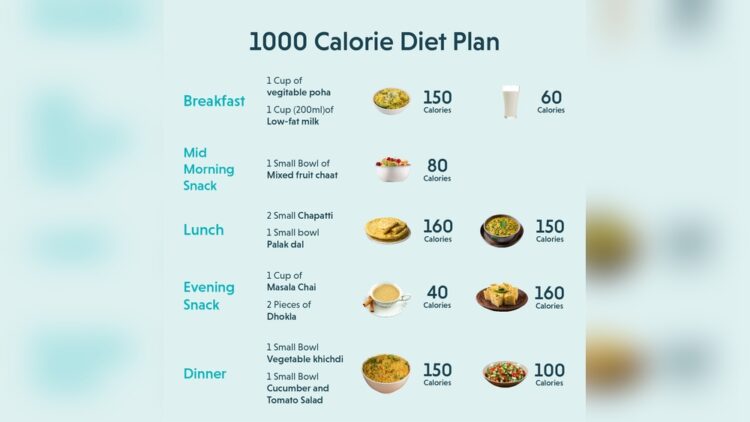

Credit: unicornmedispa.com

Exploring Payment Options

Medi Weight Loss often requires patients to manage payment independently. Insurance coverage for weight loss programs is not typical. One should confirm with their insurance provider. A range of alternative payment methods exists. Patients can use credit cards, health savings accounts (HSAs), or flexible spending accounts (FSAs). Personal loans and payment plans might also be an option.

| Payment Method | Details |

|---|---|

| Credit Cards | Common and convenient but watch out for high-interest rates. |

| HSAs/FSAs | Use pre-tax dollars for eligible expenses. |

| Payment Plans | Check with the provider for structured payment options. |

| Personal Loans | Consider as a last resort due to potential high costs. |

Making The Decision: Is Medi Weight Loss Right For You?

Understanding the expenses involved in Medi Weight Loss is crucial if your insurance doesn’t cover it. Comparing the costs to potential health benefits is essential. People often ponder the value of the program against out-of-pocket costs. Studies suggest that investing in a structured weight loss plan can lead to long-term savings on health expenses. Personal health improvements and weight-related cost reductions should be factored in.

The following section showcases success stories to provide real-life context.Real-life success stories can inspire those unsure about the investment. Testimonials highlight transformations experienced by participants, often emphasizing worth beyond monetary investment. Emotional and physical benefits may outweigh the lack of insurance coverage for many.

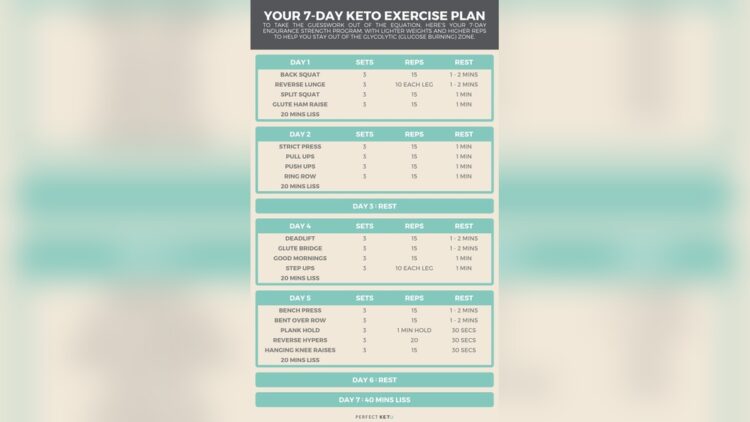

Credit: www.ninjaquestfitness.com

Conclusion

Navigating the complexities of insurance for weight loss programs can be challenging. Medi Weight Loss offers a solution, blending cost-effective treatments with potential insurance coverage. Always verify with your provider for the most accurate information. Achieving your health goals could be within reach, possibly with the aid of your insurance plan.

Take that first step and inquire today.

Leave a Reply